We are pleased to bring you Hogan Lovells 2020 False Claims Act (FCA) Guide, in which we provide our current analyses of trends in FCA enforcement. By looking back at the events of 2019 and looking forward to what lies ahead, we aim to help you navigate the frequently turbulent waters of FCA enforcement.

The Department of Justice (DOJ) recovered just over $3 billion through settlements and judgments in civil cases involving fraud and false claims against the government during fiscal year 2019, which ended September 30, 2019. This figure is up from $2.8 billion in 2018 and down from $3.5 billion in 2017. As we have warned before, it is dangerous to read too much into annual fluctuations; a handful of large recoveries may skew the numbers from year to year, and the timing of settlements is always a variable. We note that recoveries from the health care industry also rose slightly to $2.6 billion and made up more than 86 percent of total recoveries in 2019. As in the past, the vast majority of cases that resulted in recoveries in 2019 were initiated by qui tam relators.

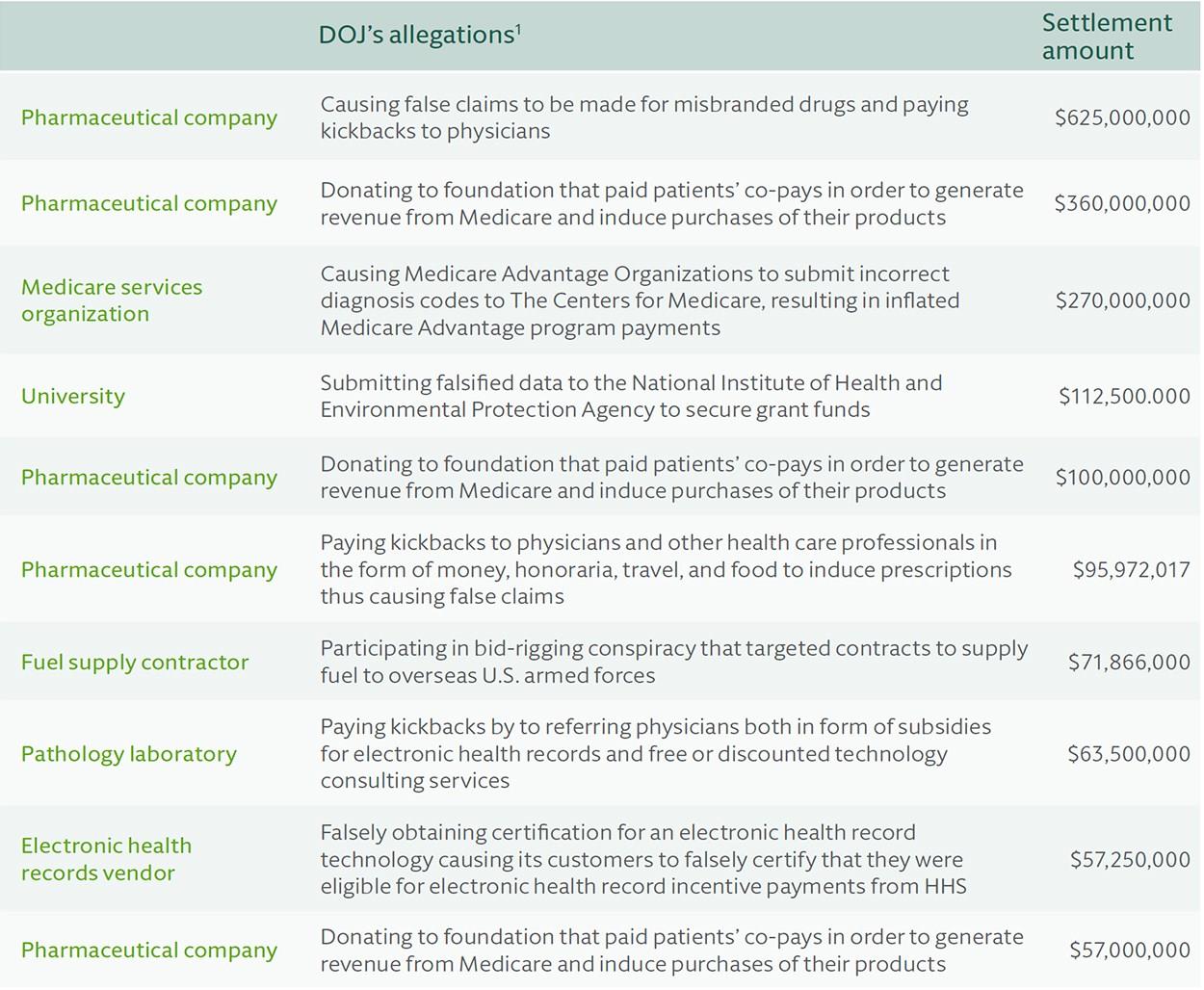

Top 10 FCA settlements in FY 2019 (in US dollars)

Guide sections

We begin our 2019 review with a discussion of the Supreme Court’s activity in the FCA arena. In May 2019, the Supreme Court unanimously held in Cochise Consultancy, Inc. v. United States ex rel. Hunt, 139 S. Ct. 1507 (2019) that a relator can file a qui tam action up to 10 years after a violation of the FCA occurs if the relator did so within three years of when the government official charged with responsibility to act in the circumstances learned of the alleged fraud. We explore the decision’s significance for defendants generally, as well as the particular impact the Court’s decision holds for those entities that submit recurring claims. We go on to summarize the several instances in which the Court denied certiorari in 2019.

Next, we explain the holding, and explore the ramifications, of United States v. AseraCare Inc., 938 F.3d 1278 (11th Cir. 2019). In AseraCare, the Eleventh Circuit determined, at least in the context of the provision of hospice benefits, that falsity cannot be based on a reasonable disagreement between medical experts. We thoroughly parse the particularities of this case, and set forth the important potential consequences for the government, relators, and defendants. Is it the boon for defendants that it at first blush appears?

We also summarize and analyze the May 2019 guidance from the DOJ’s Civil Division on cooperation credit for FCA defendants who selfdisclose, cooperate, and remediate. While similar to policies earlier promulgated by the DOJ’s Criminal Division, will the credit on offer provide sufficient certainty to entice FCA defendants to cooperate?

We then turn to the DOJ’s increased willingness to seek dismissal of relator-initiated qui tam actions, and how both courts and relators have reacted to that willingness. While 2018 established that the government was willing to seek such dismissals, 2019 confirmed that those actions were driven by concerns about the potentially extensive burdens placed on federal agencies (going well beyond the DOJ) by litigation concerning the materiality requirement articulated in Universal Health Services, Inc. v. U.S. ex rel. Escobar, 136 S. Ct. 1989 (2016). Through the prism of the National Healthcare Analysis Group (NHCA) cases, we explore the government’s approach, the relators’ tenacity in fighting back, and the courts’ developing split as to what will be the applicable standard.

Related to the government dismissal of qui tam litigations, we next discuss Polansky v. Executive Health Resources, Inc., No. 12-CV-4239, 2019 WL 5790061 (E.D. Pa. Nov. 5, 2019). Polansky is a very recent case that deals with: (1) whether and to what extent sub-regulatory agency guidance documents have the force of law; and (2) the application of the Supreme Court’s decision in Azar v. Allina Health Services, 139 S. Ct. 1804 (2019), on the materiality of non-compliance with legal or contractual requirements. As all of these issues could have significant repercussions for FCA defendants, we analyze both the decision and its implications in detail.

Moving to a new and swiftly developing risk area, we address the increased FCA risk posed by insufficient cybersecurity compliance. In the context of two recent cases, we first explore the dangers faced by defendants that “self-certify” that their IT systems provide adequate security for sensitive federal information stored, processed, or transmitted in performance of a federal contract. Next, we highlight the importance of accurately representing compliance with federal-specific cybersecurity standards when selling IT products and/or services to the government. In short, the long-standing fear that cybersecurity requirements can lead to FCA liability has become reality.

Turning to the FCA’s role in the mortgage industry, we summarize recent developments in the financial services sector. On October 28, 2019, the Department of Housing and Urban Development (HUD) and the DOJ released a Memorandum of Understanding (MOU) announcing their new joint approach to FCA enforcement against Federal Housing Administration (FHA) mortgage lenders. We explain the ins and outs of that memorandum, and also discuss the reasons for 2019’s sharp reductions in FCA recoveries in the financial services industry.

Finally, we turn to the importance of non-federal enforcement statutes, with a specific focus on the California Department of Insurance (CDI) and the enforcement of California’s Insurance Fraud Prevention Act (IFPA). The IFPA has become more prominent the last few years, both because the CDI itself has embraced an aggressive approach and because relators have realized that the IFPA provides an avenue to secure a bounty for reclaiming alleged frauds on private as well as public insurers. Given this increased prominence for a heretofore neglected statute, we summarize and explain what this means for health care providers, device and pharmaceutical manufacturers, and any other entity that offers goods and services reimbursed by public and private insurance.

The road ahead

Looking ahead, we survey some of the areas where FCA litigation in 2020 is likely to produce equally significant and interesting developments. We hope that you find this publication is a useful resource.

References

1. The claims resolved by these settlements are allegations only and there has been no admission of, or determination of, wrongdoing.